There are tons of possibilities for people trading forex personally. After you have informed yourself about forex, it is time to work hard and make a profit. It is advisable for new traders to gather information and advice from those who have been in the market for a while. A few of the ins and outs of forex trading are explained in this article.

Gather all the information you can about the currency pair you choose to focus on initially. You can’t expect to know about all the different types of pairings because you will be spending lots of time learning instead of actually trading. Concentrate on learning all you can about the pair you choose. Follow and news reports and take a look at forecasting for you currency pair.

When you are looking at forex patterns, remember that there are going to be both up and down market trends in play, but one usually dominates. It is simple and easy to sell the signals in up markets. Your goal is to try to get the best trades based on observed trends.

Never position yourself in forex based on other traders. Successes are widely discussed; however, failures are usually not spoken of by forex traders. A history of successful trades does not mean that an investor never makes mistakes. Rather than using other traders’ actions to guide your own, follow your own cues and strategy.

If you want to keep your profits, you have to properly manage the use of margin. Margin use can significantly increase profits. Be careful not to use it in a careless manner, or you will lose more than what you should have gained. Margin should be used when your accounts are secure and there is overall little risk of a shortfall.

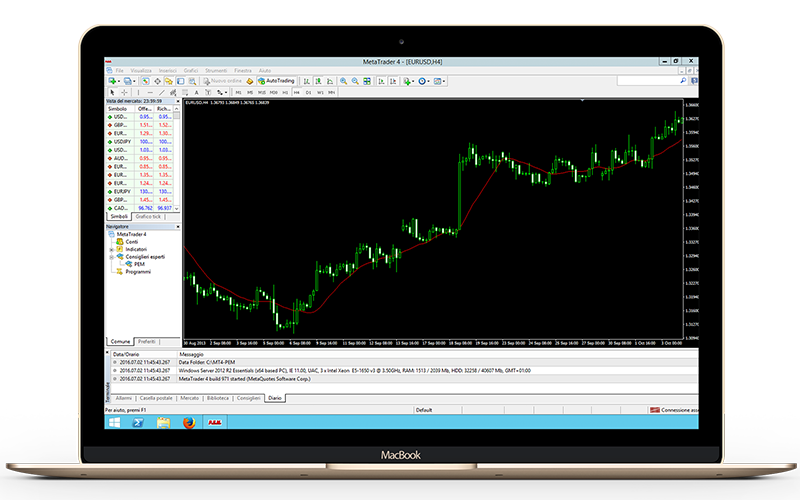

Forex has charts that are released on a daily or four hour basis. Modern technology and communication devices have made it easy to track and chart Forex down to every quarter hour interval. However, these short cycles are risky as they fluctuate quite frequently. You can bypass a lot of the stress and agitation by avoiding short-term cycles.

Forex should be taken seriously, and not thought of as a game. If you want to be thrilled by forex, stay away. People should first understand the market, before they even entertain the thought of trading.

Vary the positions that you use. Many traders jeopardize their profits by opening up with the same position consistently. Use current trades in the Forex market to figure out what position to change to.

If you put all of your trust into an automated trading system but don’t understand how it works, you may put too much of your faith and money into its strategy. Profit losses can result because of this.

The correct timing and placement of stop losses on the Forex market may seem to be more like an art then a science. You need to take note of what the analytics tell you, and combine them with your trader’s instinct to beat the market. Practice and experience will go far toward helping you reach the top loss.

Learn how to get a pulse on the market and decipher information to draw conclusions on your own. Being self-sufficient is critical to success in the currency markets.

The opposite is actually the best thing to do. Utilizing a strategy will help you to avoid making decisions based on emotions.

One piece of advice that many successful Forex traders will provide you is to always keep a journal. Write down both positive and negative trades. When you have such a record to review, you will have a better grasp of your past forex efforts, a useful tool for planning future trading and hopefully, an all-around more profitable trading experience.

Unless they possess the patience and financial stability for the maintenance of a long-term plan, most forex traders should avoid trading against markets. You should never go against the marketing when you trade. Traders that know a lot should never do this either, it can be stressful.

Do not worry about the central forex market being wiped out; there isn’t one. There aren’t any natural disasters that can obliterate the market. If a huge natural disaster occurs in Europe, that doesn’t mean you need to panic and starting dropping all of your Yen currency. Of course, a major event could and probably will affect the market, but won’t affect the currency pair that you dealing with.

For this strategy to be successful, indicators should show that the bottoms and tops of the markets have actually formed. This is still extremely risky, but you will have a better chance for success by employing patience and verifying the bottom and top before trading.

Make a point of personally monitoring your trading deals. Software is not an adequate substitute for involving yourself in the market. No matter how much mathematics goes into it and how much analysis is done on it, forex trading remains reliant on rational human decisions at critical moments.

Never change a stop point. Stop loss points are your protection against losing your shirt. Remember why you use a stop point in the first place. This will only result in you losing money.

When starting out in Forex, take plenty of time to practice your trading skills with demo platforms before experiencing the real thing. Using the demo platform when starting out is the best idea in order for you to gain knowledge about forex in general and also to get the hang of trading before you jump into the game for real.

Paying close attention to the advice and current market trends is advisable for traders new to the forex market. Anyone who is considering taking up Forex trading should take advantage of the helpful advice presented in this article. Taking expert advice, gaining knowledge and working hard leads to successful forex trading.